AxiaFunder HDR Investment Returns and Volumes

AxiaFunder have been funding UK Housing Disrepair Litigation Claims since May 2022.

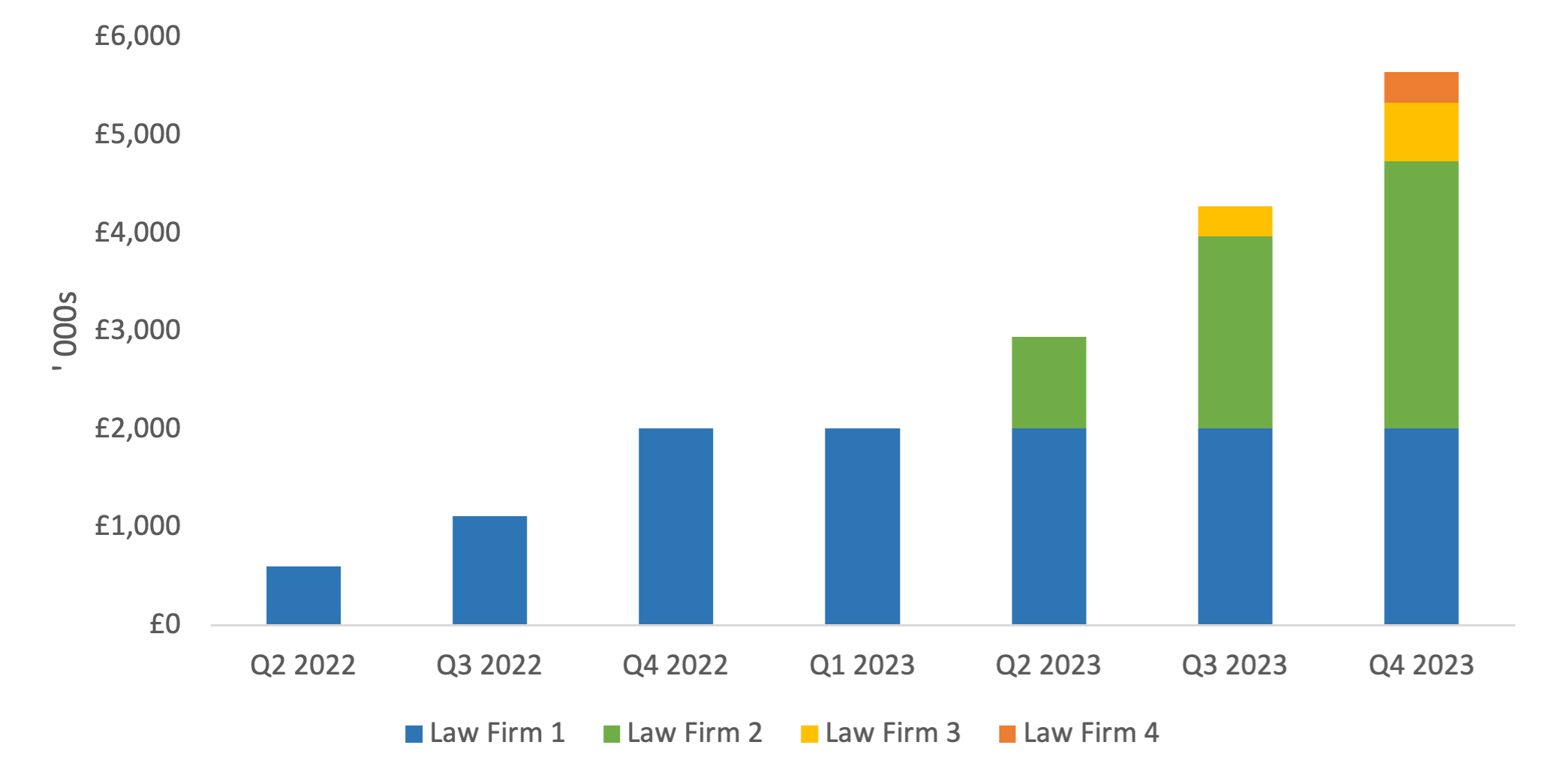

- Cumulative investment volume HDR funding: £5.7m

- Average net investor return for all repaid claims: 20.8%

- Average net return for the 6th repaid tranche of the first funded SPV (at 18 months): 43.3%

HDR Investment Return and Volume

AxiaFunder has been funding UK Housing Disrepair Litigation Claims since May 2022— raising £5.7m across 18 separate limited partnership Special Purpose Vehicles (SPVs). We are pleased to report that 1,637 individual claims have already been funded, of which 255 have settled with the SPVs paid in full.We have now funded four law firms, of which we continue to fund three. We are optimistic that the target investor returns for each Offer will be met.

Figure 1: Housing Disrepair Cumulative Portfolio Funding by Law Firm (£’000s)

Source: AxiaFunder

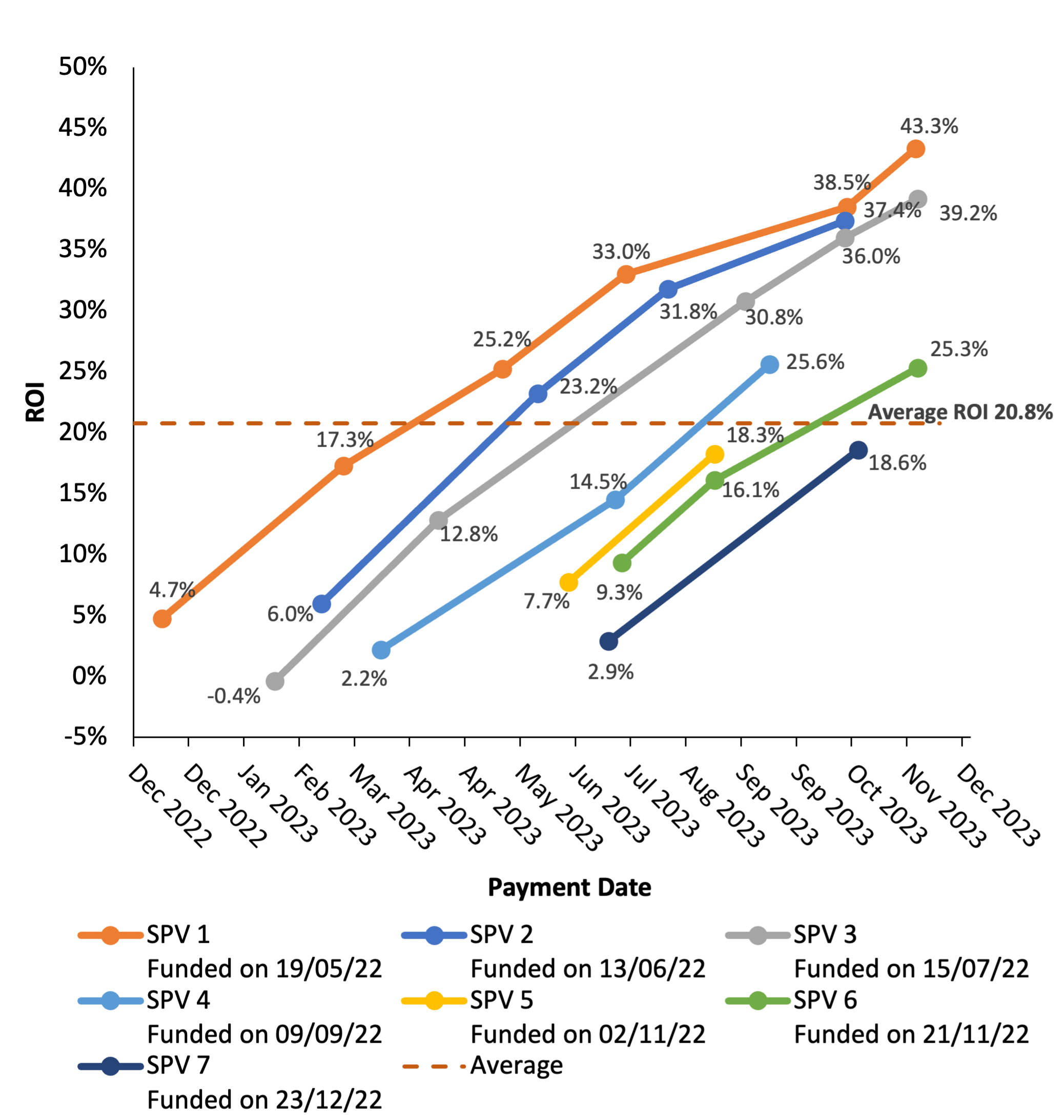

Return on Investment (ROI) for Sequential 10%-tranches

When 10% of the claims (a ‘10%-tranche’) in an SPV settle we repay investors the principal and return. So, for a given SPV, investors can expect 10 individual payments, as claims settle. The net investor returns for the first 7 SPVs are shown below. The dots show the investor net gains by tranche and time of the tranche payment. So, for example, looking at SPV1 funded in May 2022, the first 10%-tranche had an investor return of 4.7% in December 2022 7 months after the Offer launch, followed by returns of 17.3% and 25.2% in March and May 2023 from the second and third tranches respectively. In total 25 10%-tranches have been repaid, together comprising 220 resolved claims (out of 604 claims funded by these 7 SPVs). The average gain to investors across the settled claims is 20.8%. Contractually, claims that settle after a longer period tend to generate a higher return, e.g. the 5th and 6th tranches of SPV3 and SPV1 have generated returns of 39.2% and 43.3%, respectively.

Figure 2: Investor Return on Investment (ROI) for Sequential 10%-tranches, for SPVs with Repayments

Source: AxiaFunder

Note: The returns on investment are not annualised.

Disclaimer: Past returns from these SPVs are not a guarantee of future returns.

As shown above, SPVs typically only start to return cash to investors after approximately 6-9 months. We expect to be able to repay investors on 10%-tranches from the 2nd and 3rd law firm early in Q1 2024e. From offer launch, we expect the SPVs to run for 12-24 months.

AxiaFunder’s Notes

HDR claims are a mature and predictable claim type in our view. Any unsuccessful claims are contractually replaced by the law firm at no charge to the SPV which clearly improves investors’ returns. We closely monitor the individual claims and are in active dialogue with each law firm to make sure the claim portfolios are well-managed.

- The Investor Appropriateness Test

- Risks for investors in litigation funding

- AxiaFunder Wins Innovative Lender of The Year Award

- AxiaFunder Housing Disrepair Investment Returns

- AxiaFunder FCA Direct Authorisation

- AxiaFunder won Innovative Lender of the Year Award

- Access to litigation investments

- The Peer2Peer Finance News Power 50 2022

- AxiaFunder Review by P2P Platforms

- AxiaFunder Review by 4thWay

- AxiaFunder interview with CEO Cormac Leech

- AxiaFunder Targets Double-Digit IRRs

- AxiaFunder Review in iTech Post

- AxiaFunder launched new litigation finance product

- Back the suits who are bankrolling disputes

- Catalysing class actions using litigation funding

- Introduction to litigation funding

- Litigation funding and access to justice

- Financial Thing: Q&A with AxiaFunder

- Innovations in Litigation Funding Digital Event