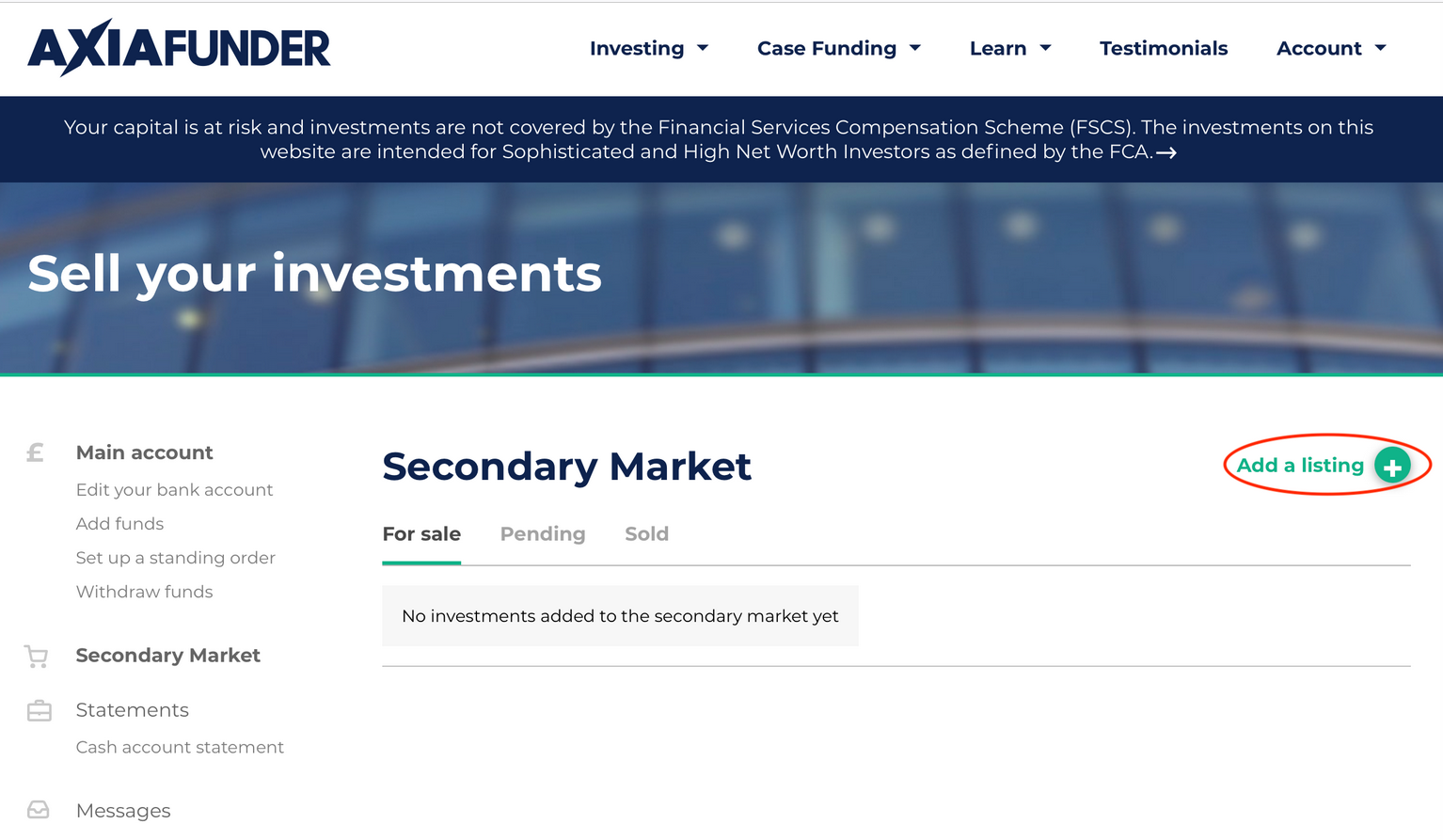

How do I list the holdings I wish to sell?

Don’t invest unless you’re prepared to lose all the money you invest. This is a high - risk investment and you are unlikely to be protected if something goes wrong. Take 2 mins to learn more

Secondary Market

The AxiaFunder Secondary Market operates as Bulletin Board offering opportunities for investors to purchase holdings in previously funded cases that are still in progress. The Secondary Market offers flexibility to Axia investors

[1] Although any specific offer could have a shorter or longer maturity than this.

Investors

Litigation funding investors have some choice as to when you exit an investment (so long as there is a buyer and your investment is eligible for the Secondary Market).

Sellers

Sellers (existing Axia Investors) can choose to place all or part of their investment on sale if a case is eligible to be listed on the Secondary Market.

Buyers

Buyers can only request to buy holdings that are displayed as available on the Secondary Market. Please ensure you read the updates section for the case before you make any decision regarding investing. You can view what is available here.

Secondary Market trading activity

Table 1 below contains information on all recent secondary market trading activity regarding cases funded via the AxiaFunder platform.

Table 1: Secondary Market Trading Activity

| Deal | Trade Completion Date | # Units Sold | Unit Price (£) | % Change v. Issuance Price |

|---|---|---|---|---|

| Breach of Employment Contract ID 2072 | 02-Sep-2021 | 374 | £15.00 | +50 % |

| 31-Aug-2021 | 100 | £15.00 | +50 % | |

| 30-Aug-2021 | 50 | £15.00 | +50 % | |

| 14-May-2021 | 9 | £15.00 | +50 % | |

| 13-May-2021 | 1 | £15.00 | +50 % | |

| Francovich claim (breach of EU Law). Offer ID 2244 | 25-Jul-2023 | 100 | £12.00 | +20 % |

| 18-Mar-2023 | 77 | £13.00 | +30 % | |

| 14-Feb-2023 | 200 | £12.50 | +25 % | |

| 05-Feb-2023 | 300 | £12.50 | +25 % | |

| 05-Feb-2023 | 300 | £12.50 | +25 % | |

| 30-Jan-2023 | 700 | £12.50 | +25 % | |

| 28-Dec-2022 | 100 | £12.50 | +25 % | |

| 11-Nov-2022 | 150 | £12.50 | +25 % | |

| 01-Nov-2022 | 150 | £12.50 | +25 % | |

| 11-Oct-2022 | 96 | £12.50 | +25 % | |

| 11-Oct-2022 | 100 | £12.00 | +20 % | |

| 22-Sep-2022 | 100 | £13.00 | +30 % | |

| 04-Aug-2022 | 200 | £6.00 | -40 % | |

| 25-Jul-2022 | 400 | £8.00 | -20 % | |

| 27-Jun-2022 | 250 | £9.00 | -10 % | |

| 10-May-2022 | 389 | £10.00 | 0 % | |

| 10-May-2022 | 250 | £9.00 | -10 % | |

| 07-Feb-2022 | 100 | £10.00 | 0 % | |

| 03-Oct-2021 | 300 | £12.50 | +25 % | |

| 21-Sep-2021 | 200 | £12.50 | +25 % | |

| 17-Sep-2021 | 200 | £12.00 | +20 % | |

| 03-Sep-2021 | 100 | £12.50 | +25 % | |

| 02-Sep-2021 | 600 | £11.50 | +15 % | |

| Breach of Employment Contract Case ID 2512 | 30-Jul-2022 | 100 | £14.00 | +40 % |

| 06-Oct-2021 | 1,861 | £13.00 | +30 % | |

| 08-Sep-2021 | 49 | £13.00 | +30 % | |

| 04-Sep-2021 | 105 | £14.00 | +40 % | |

| 01-Sep-2021 | 96 | £11.00 | +10 % | |

| Software Theft & Copyright Infringement (Case ID: 2754) | 07-Nov-2023 | 1 | £700.00 | +40 % |

| 09-Jul-2023 | 4 | £700.00 | +40 % | |

| 30-Jan-2023 | 6 | £700.00 | +40 % | |

| Francovich Claim Case ID 2817 | 14-Feb-2023 | 10 | £650.00 | +30 % |

| 05-Feb-2023 | 5 | £575.00 | +15 % | |

| 15-Mar-2022 | 2 | £515.00 | +3 % | |

| 08-Mar-2022 | 2 | £500.00 | 0 % | |

| Shareholder dispute (Case ID: 3565) | 19-Dec-2022 | 1 | £1,000.00 | 0 % |

| Group Litigation Claim (Case ID: 3634) | 08-Jul-2023 | 4 | £600.00 | +20 % |

| Shareholder Unfair Prejudice Dispute Claim (Case ID: 3903) | 27-May-2024 | 1 | £1,050.00 | +5 % |

| 25-Oct-2023 | 1 | £1,200.00 | +20 % | |

| 23-Oct-2023 | 1 | £1,150.00 | +15 % | |

| 29-Aug-2023 | 1 | £1,100.00 | +10 % | |

| Housing Disrepair Claims (Case ID: 4006) | 19-Dec-2022 | 1 | £1,000.00 | 0 % |

| Francovich Claim (Case ID: 4101) | 24-Oct-2023 | 1 | £1,200.00 | +20 % |

| 11-Sep-2023 | 3 | £1,200.00 | +20 % | |

| 08-Sep-2023 | 1 | £1,200.00 | +20 % | |

| 21-Aug-2023 | 4 | £1,300.00 | +30 % | |

| Housing Disrepair Claims (Case ID: 4237) | 22-Jan-2024 | 1 | £1,000.00 | 0 % |

| Housing Disrepair Claims (Case ID: 4882) | 02-Jan-2024 | 2 | £1,080.00 | +8 % |

| 27-Dec-2023 | 3 | £1,080.00 | +8 % | |

| Housing Disrepair Claims (Case ID: 5084) | 17-May-2024 | 1 | £1,040.00 | +4 % |

| Housing Disrepair Claims (Case ID: 5182) | 17-May-2024 | 1 | £1,040.00 | +4 % |

| Housing Disrepair Claims (Case ID: 5266) | 06-Jan-2025 | 4 | £1,040.00 | +4 % |

| Housing Disrepair Claims (Case ID: 5271) | 18-Jun-2025 | 1 | £1,040.00 | +4 % |

| 26-Nov-2024 | 1 | £1,040.00 | +4 % | |

| 30-Aug-2024 | 1 | £1,025.00 | +2 % | |

| Diesel Emissions Group Litigation (Case ID: 5393) | 01-Jul-2025 | 1 | £1,150.00 | +15 % |

| 04-Jun-2025 | 1 | £1,150.00 | +15 % | |

| 24-Apr-2025 | 1 | £1,150.00 | +15 % | |

| 16-Apr-2025 | 1 | £1,140.00 | +14 % | |

| 01-Apr-2025 | 1 | £1,100.00 | +10 % | |

| 25-Mar-2025 | 1 | £1,110.00 | +11 % | |

| 11-Feb-2025 | 1 | £1,100.00 | +10 % | |

| 03-Feb-2025 | 1 | £1,140.00 | +14 % | |

| 28-Jan-2025 | 1 | £1,140.00 | +14 % | |

| 03-Dec-2024 | 2 | £1,150.00 | +15 % | |

| 21-Sep-2024 | 1 | £1,000.00 | 0 % | |

| 21-Sep-2024 | 5 | £1,025.00 | +2 % | |

| 02-Sep-2024 | 1 | £1,040.00 | +4 % | |

| Housing Disrepair Claims (Case ID: 5395) | 30-Jun-2025 | 1 | £1,000.00 | 0 % |

| 06-Jan-2025 | 3 | £1,040.00 | +4 % | |

| 02-Oct-2024 | 2 | £1,040.00 | +4 % | |

| 17-May-2024 | 1 | £1,040.00 | +4 % | |

| Housing Disrepair Claims (Case ID: 5400) | 10-Feb-2025 | 1 | £1,040.00 | +4 % |

| 31-Oct-2024 | 2 | £1,040.00 | +4 % | |

| 17-May-2024 | 2 | £1,040.00 | +4 % | |

| Housing Disrepair Claims (Case ID: 5401) | 10-Feb-2025 | 1 | £1,040.00 | +4 % |

| 17-Sep-2024 | 2 | £1,040.00 | +4 % | |

| 29-Aug-2024 | 1 | £1,040.00 | +4 % | |

| Francovich Claim (Offer ID: 5416) | 17-May-2024 | 1 | £1,040.00 | +4 % |

| Diesel Emissions Group Litigation (Case ID: 5429) | 30-Jun-2025 | 1 | £1,010.00 | +1 % |

| 05-Jun-2025 | 1 | £1,150.00 | +15 % | |

| 01-Jun-2025 | 1 | £1,150.00 | +15 % | |

| 07-May-2025 | 2 | £1,150.00 | +15 % | |

| 22-Apr-2025 | 2 | £1,150.00 | +15 % | |

| 04-Apr-2025 | 1 | £1,110.00 | +11 % | |

| 02-Apr-2025 | 1 | £1,100.00 | +10 % | |

| 10-Feb-2025 | 1 | £1,140.00 | +14 % | |

| 28-Jan-2025 | 1 | £1,140.00 | +14 % | |

| 05-Oct-2024 | 1 | £1,150.00 | +15 % | |

| 01-Oct-2024 | 1 | £1,150.00 | +15 % | |

| 24-Sep-2024 | 1 | £1,150.00 | +15 % | |

| Housing Disrepair Claims (Case ID: 5432) | 10-Feb-2025 | 1 | £1,025.00 | +2 % |

| 29-Jul-2024 | 1 | £1,040.00 | +4 % | |

| Housing Disrepair Claims (Case ID: 5434) | 26-May-2025 | 1 | £1,040.00 | +4 % |

| 10-Feb-2025 | 1 | £1,025.00 | +2 % | |

| 29-Jul-2024 | 1 | £1,040.00 | +4 % | |

| 29-Jul-2024 | 1 | £1,040.00 | +4 % | |

| Housing Disrepair Claims (Case ID: 5446) | 20-Jun-2025 | 1 | £1,040.00 | +4 % |

| 19-Jun-2025 | 1 | £1,040.00 | +4 % | |

| 05-Jun-2025 | 1 | £1,000.00 | 0 % | |

| 02-Jun-2025 | 1 | £1,040.00 | +4 % | |

| 28-Apr-2025 | 1 | £1,040.00 | +4 % | |

| Diesel Emissions Group Litigation (Case Id: 5459) | 13-Jun-2025 | 1 | £1,150.00 | +15 % |

| 06-Jun-2025 | 1 | £1,150.00 | +15 % | |

| 01-Jun-2025 | 1 | £1,150.00 | +15 % | |

| 14-May-2025 | 2 | £1,150.00 | +15 % | |

| 09-May-2025 | 2 | £1,150.00 | +15 % | |

| 19-Nov-2024 | 1 | £1,150.00 | +15 % | |

| 23-Oct-2024 | 1 | £1,150.00 | +15 % | |

| Housing Disrepair Claims (Case ID: 5475) | 28-May-2025 | 1 | £1,040.00 | +4 % |

| 10-Feb-2025 | 1 | £1,000.00 | 0 % | |

| Software Theft & Copyright Infringement (Case ID: 5485) | 29-May-2025 | 1 | £1,200.00 | +20 % |

| 10-Jan-2025 | 1 | £1,200.00 | +20 % | |

| 27-Nov-2024 | 1 | £1,200.00 | +20 % | |

| 02-Oct-2024 | 1 | £1,180.00 | +18 % | |

| Diesel Emissions Group Litigation (Case Id: 5490) | 05-Jun-2025 | 1 | £1,000.00 | 0 % |

| 16-May-2025 | 4 | £1,150.00 | +15 % | |

| Housing Disrepair Claims (Case ID: 5581) | 20-Jun-2025 | 1 | £1,010.00 | +1 % |

| 19-Jun-2025 | 1 | £1,040.00 | +4 % | |

| 05-Jun-2025 | 1 | £1,000.00 | 0 % | |

| 28-May-2025 | 1 | £1,040.00 | +4 % | |

| 10-Feb-2025 | 2 | £1,000.00 | 0 % | |

| Housing Disrepair Claims (Case ID: 5598) | 27-May-2025 | 1 | £1,040.00 | +4 % |

| Housing Disrepair Claims (Case ID: 5607) | 05-Jun-2025 | 1 | £1,000.00 | 0 % |

| 28-Apr-2025 | 1 | £1,080.00 | +8 % | |

| 10-Feb-2025 | 1 | £1,025.00 | +2 % | |

| Housing Disrepair Claims (Case ID: 5617) | 05-Jun-2025 | 1 | £1,000.00 | 0 % |

| 02-Jun-2025 | 1 | £1,040.00 | +4 % | |

| 02-May-2025 | 1 | £1,025.00 | +2 % | |

| Housing Disrepair Claims (Case ID: 5652) | 19-Jun-2025 | 1 | £1,040.00 | +4 % |

| 02-Jun-2025 | 1 | £1,040.00 | +4 % | |

| 02-May-2025 | 1 | £1,025.00 | +2 % | |

| Housing Disrepair Claims (Case ID: 5686) | 30-Jun-2025 | 1 | £1,040.00 | +4 % |

| 05-Jun-2025 | 1 | £1,000.00 | 0 % | |

| 03-Jun-2025 | 1 | £1,040.00 | +4 % | |

| 06-May-2025 | 1 | £1,025.00 | +2 % | |

| Housing Disrepair Claims (Case ID: 5695) | 02-Jun-2025 | 1 | £1,040.00 | +4 % |

| 01-May-2025 | 1 | £1,025.00 | +2 % | |

| Housing Disrepair Claims (Case ID: 5697) | 30-May-2025 | 1 | £1,040.00 | +4 % |

| 06-May-2025 | 1 | £1,025.00 | +2 % | |

| Housing Disrepair Claims (Case ID: 5708) | 27-Jun-2025 | 1 | £1,040.00 | +4 % |

| 30-May-2025 | 1 | £1,040.00 | +4 % | |

| Housing Disrepair Claims (Case ID: 5709) | 30-Jun-2025 | 1 | £1,040.00 | +4 % |

| 29-May-2025 | 1 | £1,040.00 | +4 % | |

| Housing Disrepair Claims (Case ID: 5725) | 30-Jun-2025 | 1 | £1,040.00 | +4 % |

| 30-May-2025 | 1 | £1,040.00 | +4 % | |

| 30-May-2025 | 1 | £1,040.00 | +4 % | |

| Housing Disrepair Claims (Case ID: 5741) | 23-Jun-2025 | 1 | £1,040.00 | +4 % |

Please ensure you read the updates section for the case before you make any decision regarding investing. To view current secondary market investments opportunities (if any), visit our investments page.

How to sell

Choose how much of your holding you’d like to sell and set your sale price (AxiaFunder will set a minimum and maximum sale price).

Read and agree to the Secondary Market Terms and Conditions.

You will be alerted via email and see all pending sales in your portfolio.

Funds will be transferred directly into your AxiaFunder account (minus fees).

How to buy

You must have cleared funds in your AxiaFunder account to make a purchase on the Secondary Market.

See all available holdings for sale on the investments page and select the holdings you would like to purchase. The minimum investment amount is £1,000.

Confirm your wish to purchase and wait to see if it is accepted. If your offer is not accepted the funds, and fees, will remain in your account.

If accepted your pledge will be fulfilled from your AxiaFunder account, fees transferred and you can monitor your investment in your portfolio.

As a seller, how long do I get to accept an offer to buy?

As a buyer how do I take a decision about what price to pay?

Where AxiaFunder permit a given investment to be sold on the Secondary Market, although the seller can put an existing investment for sale on the Secondary Market and set the price, it is subject to price constraints maximum and minimum set by AxiaFunder.

What are the fees for the Secondary Market?

Purchasers on the Secondary Market pay 3% to Axiafunder of the final accepted purchase value of a sale. Please note this fee includes Stamp Duty Reserve Tax (SDRT)

Do I need to pay tax on a Secondary Market purchase?

As a seller on the Secondary Market you give permission for your name, address and email address to be shared with HMRC. Please note we do not offer tax advice.

Is there minimum transaction size on the Secondary Market?

Get notified

of new investment opportunities and news