Don’t invest unless you’re prepared to lose all the money you invest. This is a high - risk investment and you are unlikely to be protected if something goes wrong. Take 2 mins to learn more

Track Record

Claim Statistics

Case Studies

Last updated on Monday, 9th June 2025.

Overview

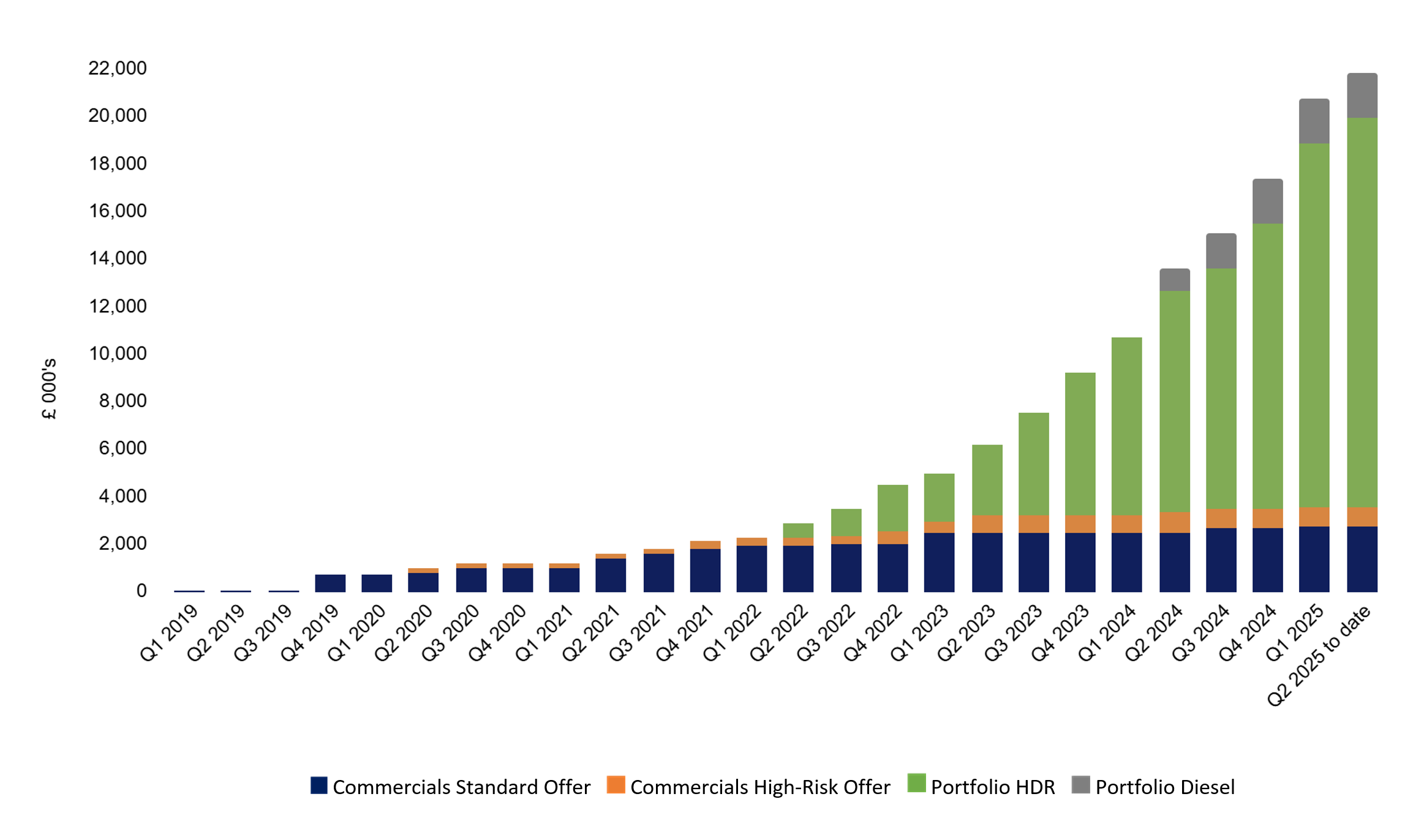

To date, AxiaFunder raised £21,818,440 for a range of commercial and portfolio investments.

Figure 1: Cumulative capital raised via AxiaFunder platform by offer type

PORTFOLIO CLAIMS - HOUSING DISREPAIR

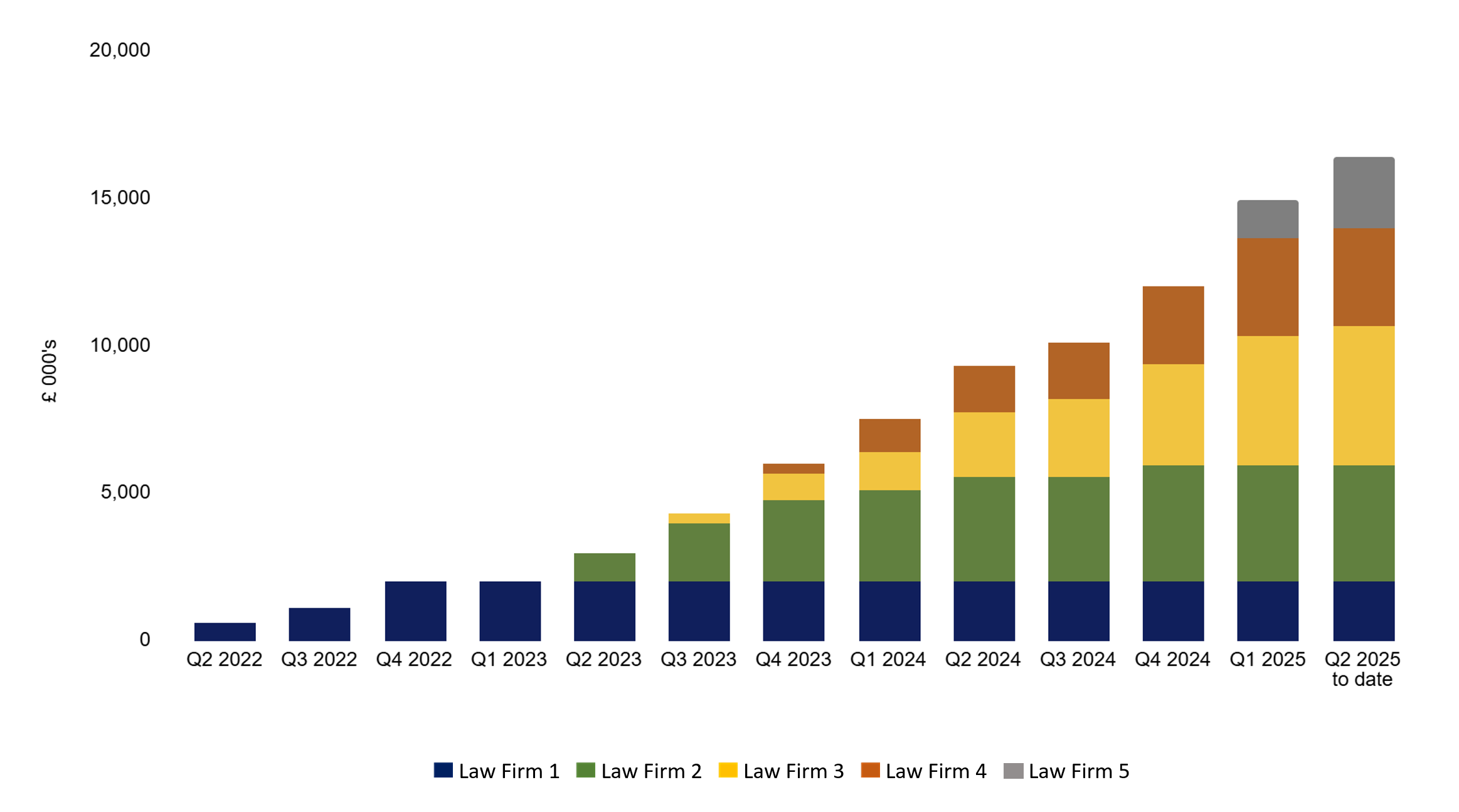

AxiaFunder has been funding UK Housing Disrepair (HDR) Litigation Claims since May 2022 - raising £16.40 million to date across 45 separate limited partnership Special Purpose Vehicles (SPVs), funding 6,213 claims.Figure 2: Cumulative HDR Portfolio Funding by Law Firm

Law Firm 1

The first funded law firm went into administration in July 2024. This law firm was funded via 7 SPVs. Investors recovered their invested capital only.

Law Firm 2

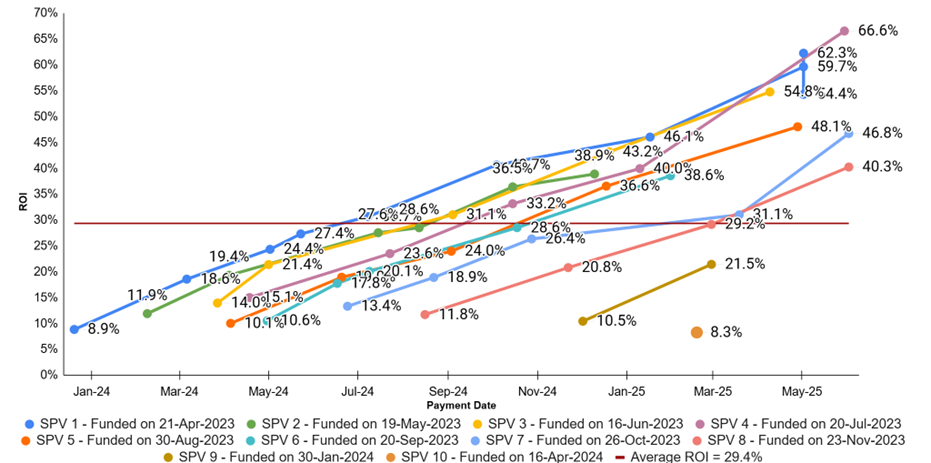

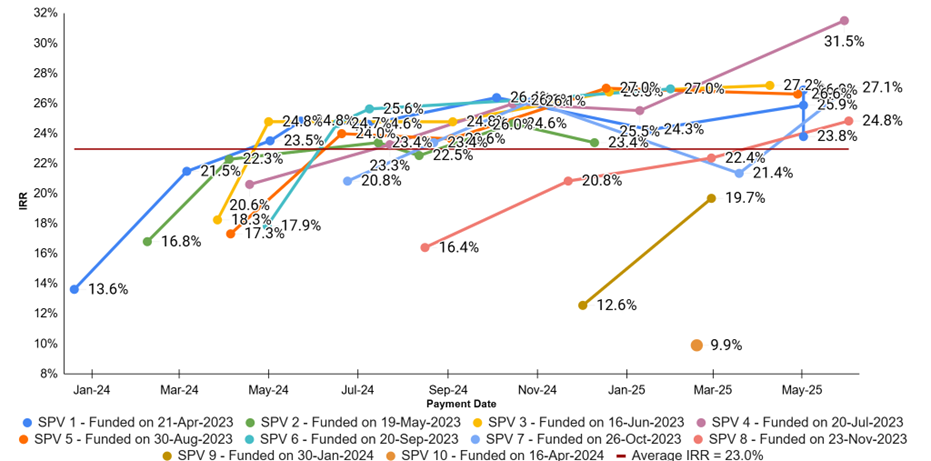

To date, 1,416 claims were funded via 11 SPVs. The net investor returns and IRRs for the first 10 SPVs are shown in Figures 3-4 below. The dots show the investor net gains (Figure 3) and IRRs (Figure 4) by tranche and time of the tranche payment. For example, looking at the resolved SPV1 funded in April 2023, the first 10%-tranche had a net investor gain of 8.9% (IRR of 13.6%) in December 2023, 8 months after the Offer launch, followed by returns of 18.6% (IRR of 21.5%), 24.4% (IRR of 23.5%), 27.4% (IRR of 24.8%), 30.7% (IRR of 24.6%), 40.7% (IRR of 26.4%), 46.1% (IRR of 24.3%), 59.7% (IRR of 25.9%), 54.4% (IRR of 23.8%) and 62.3% (IRR of 26.9%) from the subsequent tranches paid to investors between March 2024-May 2025. The average net investor gain for the resolved SPV1 is 37.3% (IRR of 23.5%).

In total, 48 10%-tranches have been repaid to date, together comprising 586 resolved claims (out of 1,265 claims funded by these 10 SPVs). The average net gain and annualised IRR to investors across the settled claims is 29.4% and 23.0%, respectively.

Contractually, claims that settle after a longer period tend to generate a higher return, e.g. the 10th tranche of SPV1 has generated returns of 62.3% (IRR of 26.9%).

Figure 3: Law Firm 2 investor net return by tranche

Figure 4: Law Firm 2 investor IRR by tranche

Law Firm 3

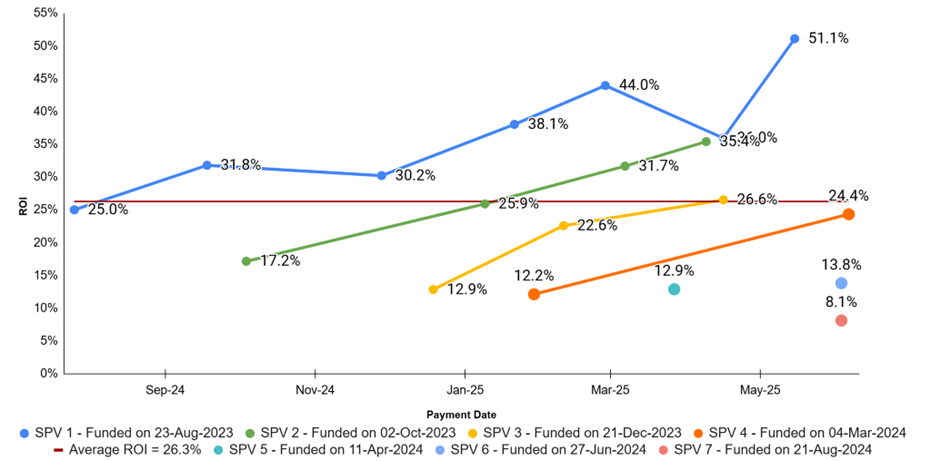

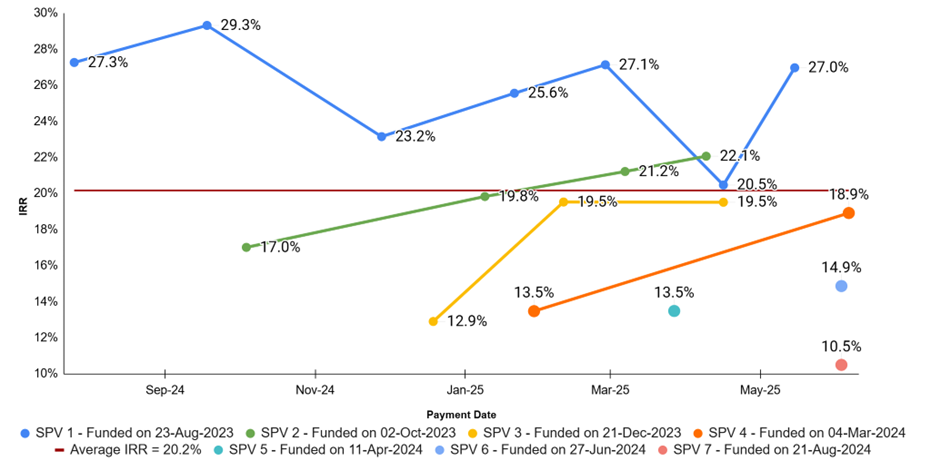

To date, 1,981 claims were funded via 12 SPVs. The net investor returns for the first 7 SPVs are shown in Figures 5-6 below. The dots show the investor net gains (Figure 5) and IRRs (Figure 6) by tranche and time of the tranche payment. For example, looking at SPV1 funded in August 2023, the first 10%-tranche had a net investor gain of 25.0% (IRR of 27.3%) in July 2024, 11 months after the Offer launch, followed by returns of 31.8% (IRR of 29.3%), 30.2% (IRR of 23.2%), 38.1% (IRR of 25.6%), 44.0% (IRR of 27.1%), 36.0% (IRR of 20.5%) and 51.1% (IRR of 27.0%) from the subsequent tranches paid to investors between September 2024-May 2025.

In total, 19 10%-tranches have been repaid to date, together comprising 264 resolved claims (out of 1,116 claims funded by these 7 SPVs). The average net gain and IRR to investors across the settled claims is 26.3% and 20.2%, respectively.

Contractually, SPV1 is entitled to receive a share of the law firm’s revenue on each claim regardless of the claim resolution timing. The other SPVs funding this law firm accrue the return daily.

Figure 5: Law Firm 3 investor net return by tranche

Figure 6: Law Firm 3 investor IRR by tranche

Law Firm 4

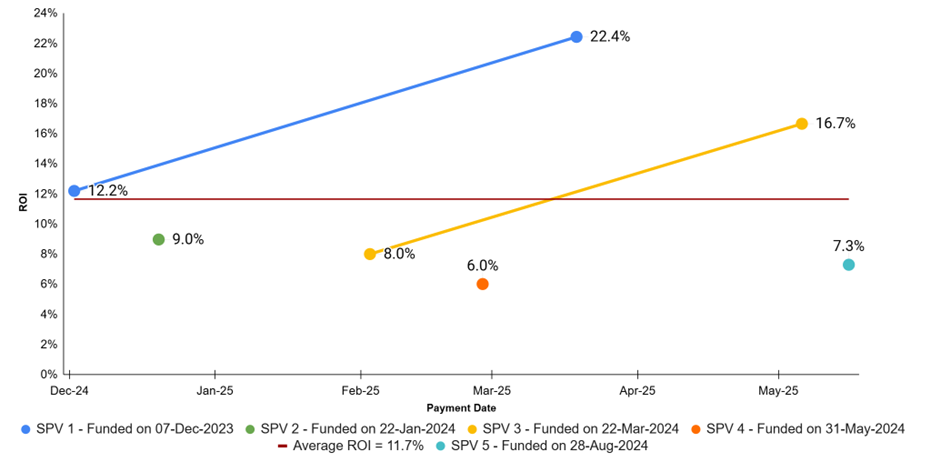

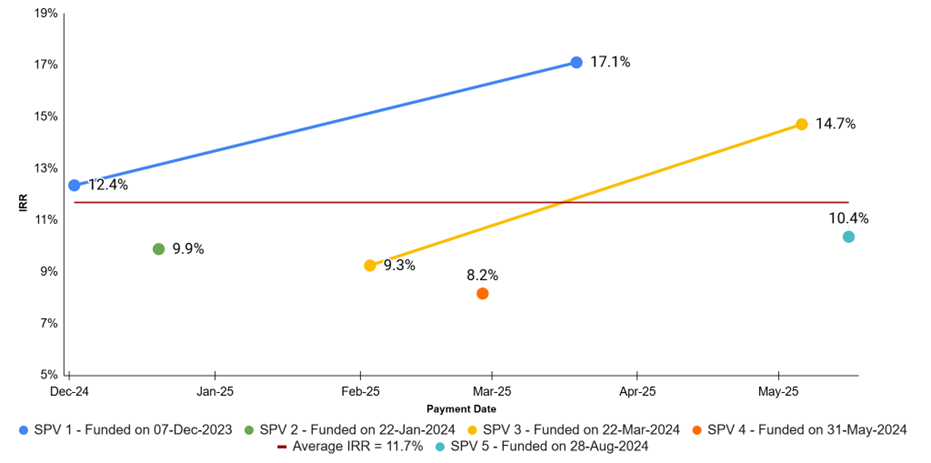

To date, 1,286 claims were funded via 9 SPVs. The net investor returns and IRRs for the first 5 SPVs are shown in Figures 7-8 below. The dot shows the investor net gain (Figure 7) and IRR (Figure 8) by tranche and time of the tranche payment. For example, looking at SPV1 funded in December 2023, the first 10%-tranche had a net investor gain of 12.2% (IRR of 12.4%) in December 2024, 12 months after the Offer launch, followed by a return of 22.4% (IRR of 17.1%) from the subsequent tranche paid to investors in March 2025.

In total, 7 10%-tranches have been repaid to date, together comprising 112 resolved claims (out of 810 claims funded by these 5 SPVs). The average net gain and IRR to investors across the settled claims is 11.7% and 11.7%, respectively.

Contractually, claims that settle after a longer period tend to generate a higher return, e.g. the 2nd tranche of SPV1 has generated returns of 22.4% (IRR of 17.1%).

Figure 7: Law Firm 4 investor net return by tranche

Figure 8: Law Firm 4 investor IRR by tranche

Law Firm 5

To date, 926 claims were funded by 6 SPVs. There have been no repayments to investors yet.

PORTFOLIO CLAIMS - DIESEL EMISSION CLAIMS

Additionally, AxiaFunder raised £1,860,000 for diesel emission claims against different car manufacturers via 4 SPVs. There have been no repayments to investors yet. If all the diesel claims settled today, investors can expect a net gain between 145% and 160%, depending on the Diesel offer that they invested into.COMMERCIAL CLAIMS

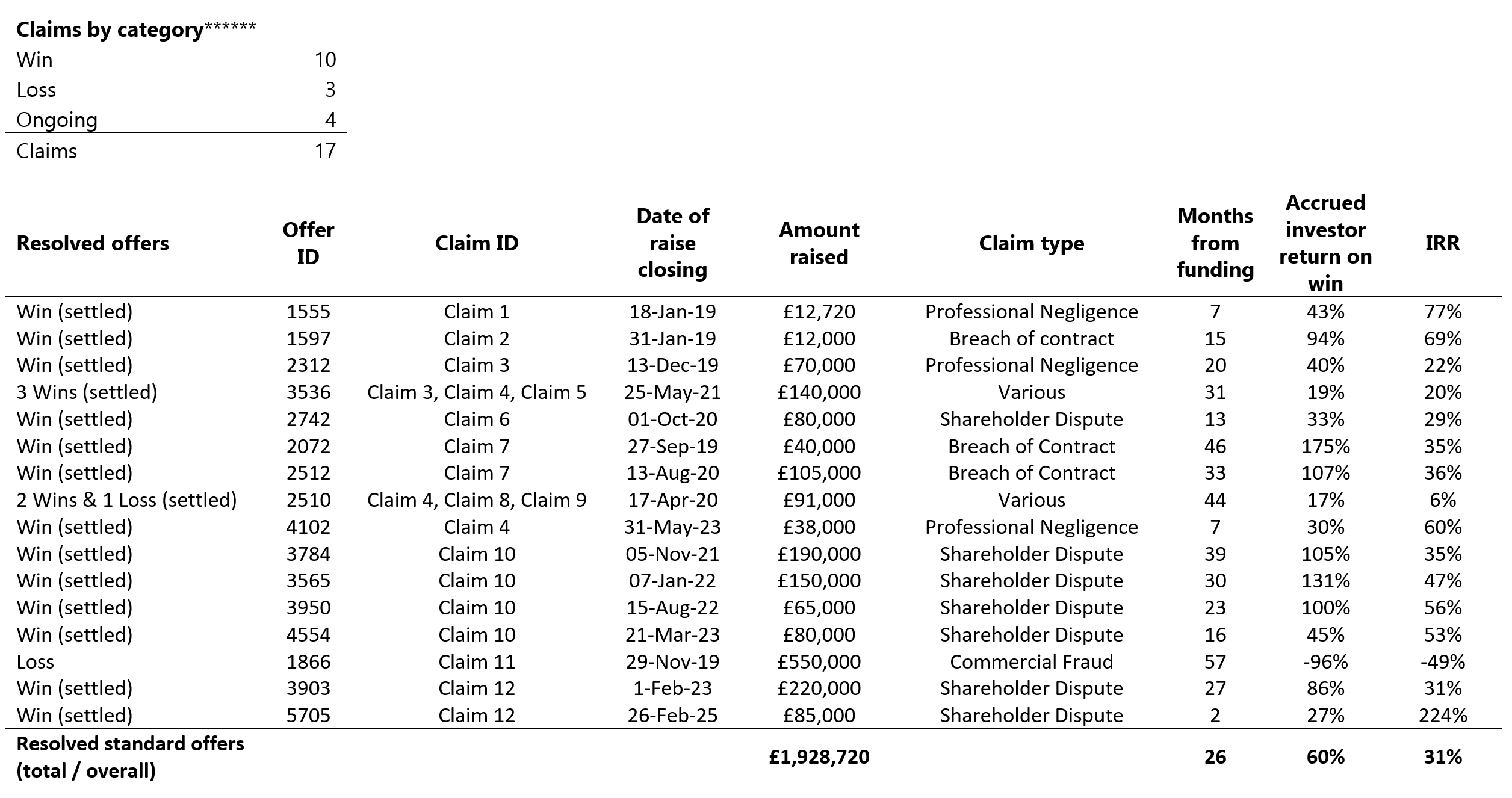

17 individual commercial claims have been fully funded via our platform, of which 10 have successfully resolved and three have resolved negatively with each corresponding offer* generating returns** for investors of between -100% and 175% over periods of time ranging between 5-57 months. Meanwhile, the other 4 claims remain ongoing. The total amount of capital raised for commercial claims is £3,563,440*** with an average IRR**** on the resolved claims equivalent to 18%. The average IRR on the standard resolved offers is 31%, and the average IRR on the high risk***** offers is -89%. Some claims (see Claim ID) have been funded via multiple offers. We calculate the return and IRRs for each Offer separately.

Figure 9: Summary overview of AxiaFunder commercial claim investments to date

NET RETURN STATISTICS

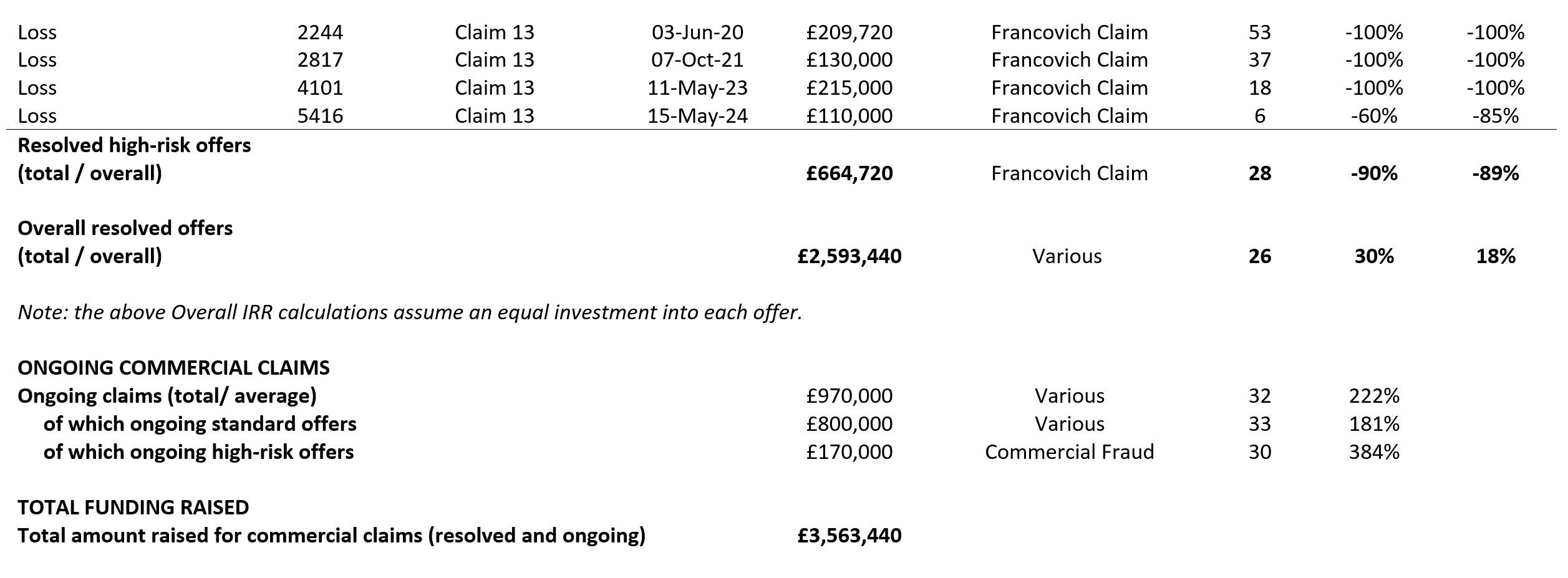

The table below outlines the annualised returns for various offers. Assuming equal amounts were invested in each resolved offer, the IRR is 14.7%. This rises to 18.7% when Law Firm 1 is excluded and to 23.6% when high-risk offers are excluded. Excluding both Law Firm 1 and high-risk offers increases the IRR to 30.0%.

In the housing-disrepair portfolio — excluding Law Firm 1 — the IRR on paid-out tranches is 22.4%. For commercial litigation offers, the overall IRR is approximately 18.0%, rising to 31.2% when high-risk offers are excluded.

Figure 10: Investor IRR: assuming equal investment in each offer

Disclaimer: Past performance is not a guarantee of future results and projected returns are not guaranteed to be realised. You should not invest unless you are willing to lose all the money you invest. This is a high-risk investment, and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more.

To view current investment opportunities (if any), visit our investments page.

* 3 claims were funded with one SPV via Offer ID 2510; 3 claims were funded with one SPV via Offer ID 3536; 5 resolved claims were funded in stages using separate SPVs.

** Net investor return accrued to date. For resolved claims this is the actual net gain after fees received by investors. For ongoing claims, this is the net return investors would get after all fees if there was an immediate claim win.

*** Total primary trading volume.

**** Internal Rate of Return (IRR); Assumes an equal investment into each offer.

***** An offer categorised as High-Risk has a higher probability of loss (and higher potential return).

****** Win means claim resolved with a positive financial return for investors. Lose means claim resolved with a negative financial return for investors.

Get notified

of new investment opportunities and news