Single Case versus Portfolio Litigation Funding

One type of investment opportunity that should live up to its claim of offering real diversification, is a portfolio of legal cases – obviously as one part of a well-structured investment strategy spread across several asset types.

While the outcome of any single case is clearly binary – the case can either win - in other words, the claimant is successful (either through a negotiated settlement or the damages awarded by the court at trial), or the case can lose. Thus, any litigation investor can significantly increase the likelihood of a positive return of their overall litigation investment by dividing their total investable sum amongst a number of claims. This can be illustrated by taking an example of the litigation investor with £10,000 to deploy in third party litigation funding.

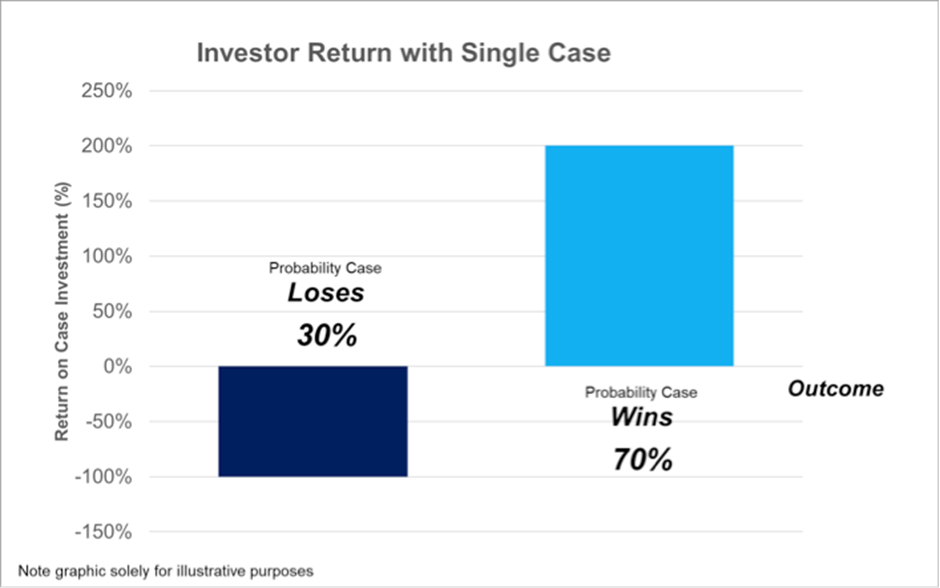

Say, in the first instance, this litigation investor allocates the entire sum in a single case that has the potential to return £3 for every £1 invested. Then, the possible scenarios for their return would look like those illustrated below assuming that non-avoidable After-The-Event insurance is in place (as with all cases listed on the AxiaFunder platform) to protect the claimant and their investors against liability for a defendant’s costs.

Despite a litigation funder’s expertise in reviewing and selecting only the cases with the highest chances of success (many funders in the market quote success rates of above 80%) that should yield the investor a sum of £30,000 (3 x £10,000) on their original stake, there is always the possibility that, for whatever reason, the claim is unsuccessful and the investor is left empty handed. To be conservative, we assume this probability is equal to 30%.

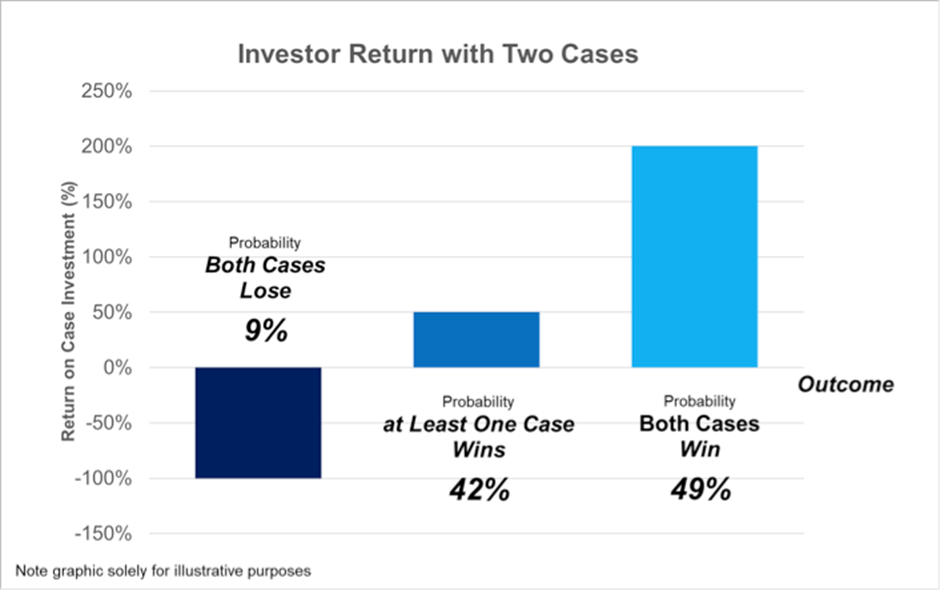

Now, instead, say the same litigation investor decides to split their capital and allocate £5,000 each into two entirely different legal claims. Assuming AxiaFunder’s legal and financial experts have done their homework and estimated that each of these cases stands at least a 70% chance of success, based on simple binomial probabilities, the range of potential outcomes would now look like this.

The investor still benefits from an outcome where both cases win with both litigation investment opportunities generating £30,000 in total (i.e. both cases generating 3 x £5,000 = £15,000 each), the probability of making a loss has now fallen to 9% (previously 30%). In other words, there is now a probability of 91% of making a return of at least 50% on the initial £10,000 capital invested.

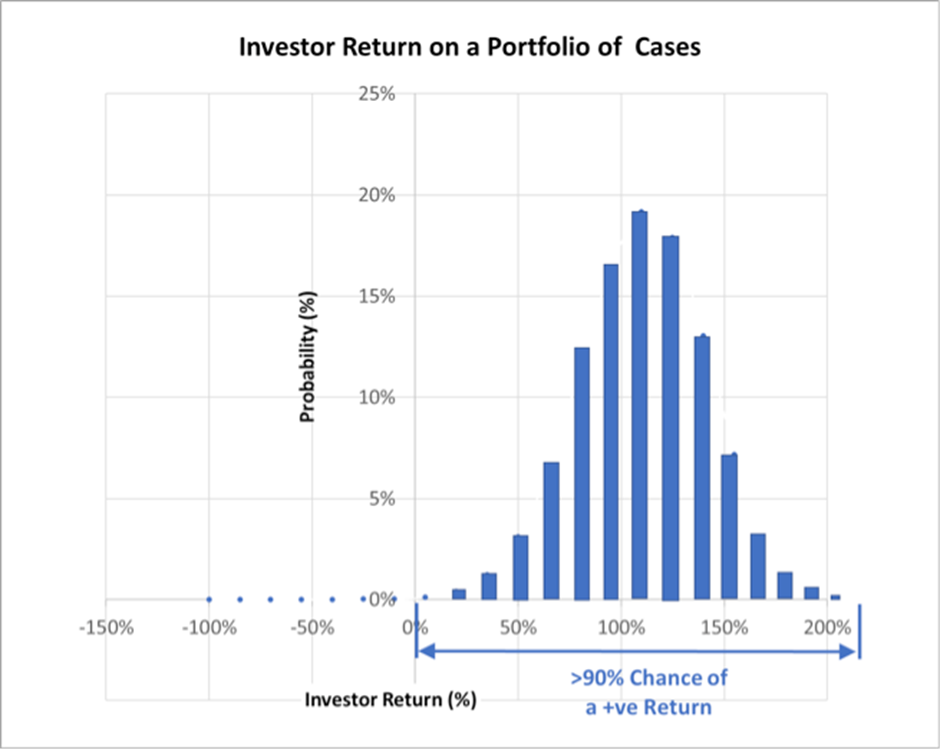

Thus, by spreading their original £10,000 investment across a higher number of lawsuits that are unrelated to each other, investors can in theory increase the likelihood of making attractive returns (and, consequently, reduce the risk of losing their entire investment) to insignificant levels as illustrated below.

Note: The graph provided solely for illustrative purposes

In fact, following these assumptions, investing in a portfolio of 10 lawsuits should, in theory, be sufficient to generate positive returns over 90% of the time. For more information, please review our Portfolio Case Simulator.

The AxiaFunder platform is set up to enable investors to review details of each case available for litigation investment and make their own choices on how many and which ones to invest in, depending on their own individual return requirements and tolerance for risk.

Hence, with AxiaFunder, litigation investors in the UK can not only participate in the attractive returns available from investing in lawsuits for the first time, but by spreading their investment across a number of legal claims, can potentially maximise their gains while, at the same time, reducing the probability of negative returns. For more information, please review our Portfolio Case Simulator. With AxiaFunder’s unique litigation case funding model, investors are always in the driving seat.

The video Why Litigation Funding Can Be Attractive on our Homepage demonstrates how the AxiaFunder litigation funding platform enables investors to diversify their risk when gaining exposure to this exciting new asset class.

- Understanding Your AxiaFunder Investment Portfolio

- The Investor Appropriateness Test

- Risks for investors in litigation funding

- Highly Commended Innovative Lenders Award

- New Podcast on the Legal Funding Journal

- 4th Way Review on Dieselgate Portfolio Investment

- AxiaFunder - actions taken to protect investors

- AxiaFunder Wins Innovative Lender of The Year Award

- AxiaFunder Housing Disrepair Investment Returns

- AxiaFunder FCA Direct Authorisation

- AxiaFunder won Innovative Lender of the Year Award

- Access to litigation investments

- The Peer2Peer Finance News Power 50 2022

- AxiaFunder Review by P2P Platforms

- AxiaFunder Review by 4thWay

- AxiaFunder interview with CEO Cormac Leech

- AxiaFunder Targets Double-Digit IRRs

- AxiaFunder Review in iTech Post

- AxiaFunder launched new litigation finance product

- Back the suits who are bankrolling disputes